How Construction Accounting Can Save You Time and Money on Your Next Project

How Construction Accounting Can Save You Time and Money on Your Next Project

Blog Article

Discovering the Value of Construction Bookkeeping in the Building And Construction Industry

The construction sector runs under unique monetary obstacles that demand a specialized technique to bookkeeping. Building and construction accounting not just ensures the accuracy of monetary reporting but additionally plays a pivotal function in project monitoring by enabling effective task costing and resource allowance. By recognizing its vital principles and benefits, stakeholders can significantly affect job end results. The intricacies integral in building and construction audit raising concerns about ideal techniques and the devices offered to manage these complexities efficiently. What strategies can construction companies execute to enhance their financial procedures and drive success?

Special Challenges of Construction Audit

Often, building accountancy offers unique challenges that identify it from other sectors. One primary challenge is the complex nature of building and construction jobs, which frequently involve several stakeholders, rising and fall timelines, and varying laws. These variables demand precise monitoring of prices connected with labor, products, equipment, and overhead to keep project earnings.

An additional significant obstacle is the requirement for exact job costing. Building firms need to allocate costs to certain tasks accurately, which can be hard due to the long period of time of jobs and the possibility for unexpected costs. This demand needs durable accounting systems and methods to make certain accurate and timely economic coverage.

In addition, the building and construction industry is susceptible to alter orders and agreement adjustments, which can additionally make complex economic tracking and forecasting. Properly accounting for these changes is vital to ensure and avoid disputes that jobs continue to be within budget plan.

Trick Principles of Building Bookkeeping

What are the fundamental principles that guide building audit? At its core, building and construction audit revolves around accurate tracking of expenses and profits connected with certain projects.

Another key principle is the application of the percentage-of-completion technique. This strategy identifies earnings and costs proportionate to the task's progression, offering a more reasonable sight of economic efficiency with time. In addition, building and construction audit stresses the importance of conformity with audit criteria and laws, such as GAAP, to make sure openness and dependability in monetary reporting.

Furthermore, cash money flow monitoring is vital, given the frequently cyclical nature of building and construction tasks. These principles jointly form a durable structure that sustains the distinct economic needs of the building sector.

Benefits of Efficient Construction Accountancy

Efficient construction accountancy gives various benefits that dramatically improve the total management of jobs. Among the key advantages is enhanced monetary presence, enabling project supervisors to track expenditures precisely and keep track of cash circulation in real-time. This transparency helps with informed decision-making, reducing the danger of spending plan overruns and making sure that resources are assigned effectively.

Furthermore, efficient building and construction bookkeeping enhances compliance with regulative demands and market criteria. By keeping precise monetary records, business can easily offer paperwork for audits and satisfy contractual responsibilities. This diligence not just fosters trust with stakeholders and clients but also reduces prospective legal risks.

Additionally, effective bookkeeping methods add to better project projecting. By assessing past performance and economic fads, building and construction firms can make more accurate forecasts concerning future project prices and timelines. best site construction accounting. This ability enhances strategic preparation and allows business to respond proactively to market changes

Tools and Software Program for Building Bookkeeping

A variety of specialized tools and software remedies are offered for construction audit, each made to simplify monetary management procedures within the market. These devices assist in tracking, reporting, and analyzing economic data details to construction jobs, guaranteeing precision and compliance with sector standards.

Leading software program choices include incorporated construction administration systems that include project monitoring, bookkeeping, and budgeting capabilities. Solutions such as Sage 300 Building and Realty, copyright for Professionals, and Point of view Vista deal includes tailored to handle work costing, payroll, and invoicing, making it possible for building and construction companies to preserve exact economic oversight.

Cloud-based applications have actually obtained popularity due to their access and real-time cooperation abilities. Tools like Procore and CoConstruct permit teams to gain access to financial information from multiple places, boosting communication and decision-making processes.

Furthermore, building accounting software program often sustains compliance with governing needs, assisting in audit trails and tax coverage. The combination of mobile applications further improves operational performance click to investigate by enabling area employees to input data straight, minimizing delays and errors.

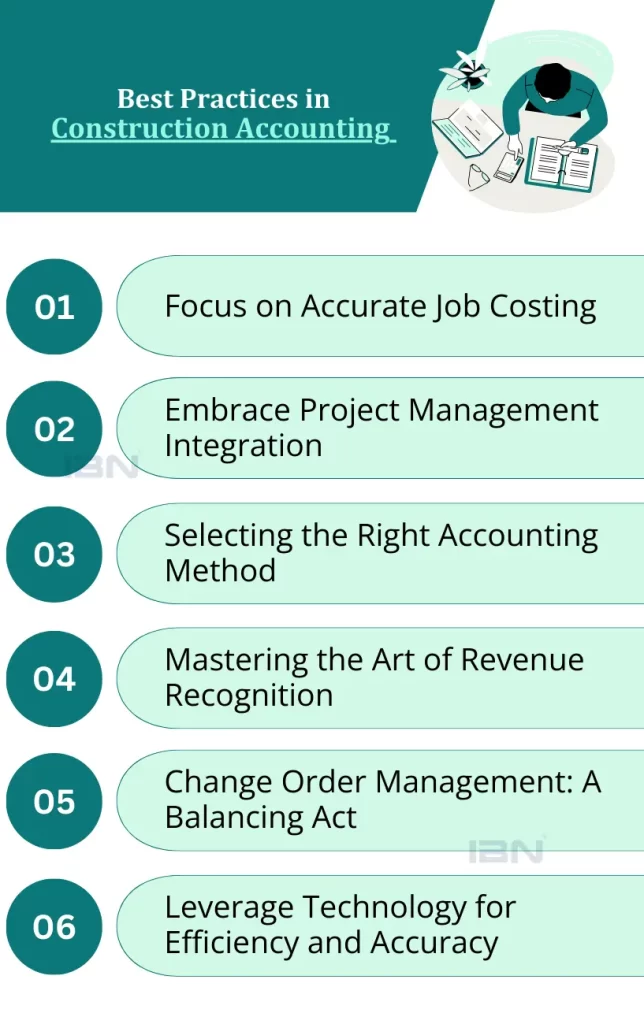

Ideal Practices for Building Financial Administration

Successful building and construction bookkeeping counts not only on the right devices and software application but likewise on the application of best techniques for financial management. To attain effective economic oversight, building companies ought to prioritize exact and normal project budgeting. This procedure entails breaking down project costs into thorough classifications, which enables much better monitoring and forecasting of expenses.

One more vital practice is keeping a durable system for invoicing and money flow administration. Timely invoicing makes sure that payments are obtained immediately, while persistent capital tracking helps prevent liquidity issues. In addition, building firms must adopt an extensive approach to task setting you back, assessing the real expenses against budgets to identify variations and adjust techniques appropriately.

Furthermore, promoting openness via comprehensive financial coverage boosts stakeholder count on and aids in notified decision-making. Normal financial testimonials and audits can likewise discover possible inefficiencies and areas for improvement. Continual training and advancement of monetary management abilities among personnel guarantee that the team continues to be adept at browsing the complexities of building accountancy. By incorporating these finest techniques, building companies can improve their monetary security and drive job success.

Conclusion

Finally, building and construction accountancy functions as a fundamental element of the building market, addressing one-of-a-kind challenges and adhering to key principles that enhance monetary precision. Effective accountancy methods generate substantial benefits, including enhanced capital and compliance with governing requirements. Utilizing appropriate tools and software even more supports monetary monitoring initiatives. By executing finest methods, building and construction companies can promote stakeholder count on and make informed decisions, inevitably contributing to the overall success and sustainability of tasks within the market.

Construction bookkeeping not only makes sure the precision of monetary coverage yet additionally plays a crucial duty in task administration by allowing effective task costing and resource allocation. Additionally, building and construction bookkeeping stresses the relevance of conformity with accountancy requirements and laws, such as GAAP, to make certain openness and dependability in monetary reporting.

Effective building and construction audit counts not just on the right tools and software yet likewise on the implementation of ideal techniques for economic management. Constant training and growth of economic Our site administration skills amongst team make sure that the team continues to be skilled at navigating the intricacies of building bookkeeping.In verdict, construction accounting offers as a fundamental part of the building industry, attending to one-of-a-kind difficulties and adhering to crucial principles that boost monetary precision.

Report this page